Private Real Estate Fund Explained: Structure, Benefits, and Real-World Examples for Modern Investors

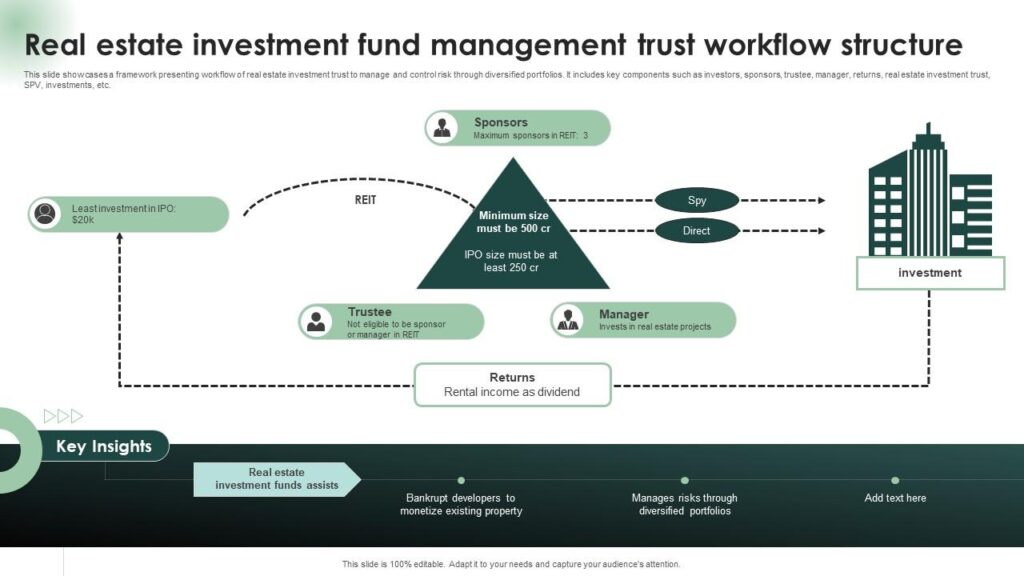

A private real estate fund is a professionally managed investment vehicle that pools capital from accredited investors, institutions, or high-net-worth individuals to acquire, manage, and develop real estate assets. These assets may include commercial buildings, residential complexes, industrial parks, or mixed-use developments. Unlike public real estate investment trusts (REITs), private funds are not traded on public exchanges and typically have restricted access and longer investment horizons.

The primary objective of a private real estate fund is to generate income through rental yields and property appreciation. Investors participate in both operational income and capital gains upon the fund’s exit or liquidation phase. The structure allows diversification across multiple real estate assets without requiring investors to manage individual properties themselves.

Private real estate funds are managed by experienced general partners (GPs) who source, evaluate, acquire, and manage properties. Limited partners (LPs), or investors, contribute capital and receive periodic distributions from rental income or asset sales. The closed-end nature of most private funds ensures a focus on long-term growth rather than short-term liquidity.

How a Private Real Estate Fund Operates

Private real estate funds typically follow a lifecycle that includes fundraising, acquisition, management, and exit. Each stage is crucial to maximizing returns and managing risk effectively.

During the fundraising phase, the fund’s managers present their strategy, target asset classes, and expected returns to prospective investors. Once the target capital is raised, the fund begins acquiring properties aligned with its investment thesis, for example, multifamily housing in growing urban centers or logistics centers near major transport hubs.

After the acquisition, the management team focuses on optimizing the portfolio. This may include property renovations, tenant negotiations, and cost efficiency measures to increase property values. Throughout the holding period, the fund distributes income generated from rental operations to investors. The exit phase occurs after a set term, often between 7 to 10 years, when properties are sold and profits distributed according to ownership percentages.

Private funds differ from REITs because they operate with less public disclosure and regulatory oversight, offering flexibility and potentially higher returns, albeit with greater illiquidity and risk.

Types of Private Real Estate Funds

Core Funds

Core funds focus on high-quality, income-generating assets in stable markets. These properties often have long-term leases with reliable tenants. Because of their low risk, core funds typically deliver moderate but steady returns. They appeal to conservative investors seeking predictable cash flow and capital preservation.

Core-Plus Funds

Core-plus funds invest in stable properties that may require minor improvements to enhance value. For instance, a fund may purchase a well-located building that needs renovation or updated tenant agreements. These investments carry slightly higher risk but also offer better upside potential.

Value-Add Funds

Value-add funds acquire underperforming or mismanaged properties that can be repositioned through renovation or operational improvements. Once the upgrades are completed and income rises, the property is either refinanced or sold for profit. These funds target higher returns in exchange for moderate risk.

Opportunistic Funds

Opportunistic funds target high-risk, high-return projects such as ground-up developments, distressed assets, or properties in emerging markets. They often require significant capital and long timelines,s but can yield substantial gains when executed correctly.

Real-World Examples of Private Real Estate Funds

Blackstone Real Estate Partners

Blackstone Real Estate Partners is one of the largest private real estate funds globally. The firm invests across a wide spectrum of properties from office towers and logistics centers to residential complexes and hotels. Its diversified approach has consistently delivered strong risk-adjusted returns by leveraging scale, data analytics, and global market expertise.

Blackstone’s success stems from strategic property acquisitions during economic downturns and its ability to reposition assets for long-term value. The firm also integrates technology to manage portfolios and enhance transparency for investors through digital dashboards and reporting tools.

Brookfield Property Partners

Brookfield’s private real estate funds focus on iconic properties in major global cities. Their strategy combines stable cash-flowing assets with value-add opportunities. The company has expanded into multifamily, industrial, and hospitality sectors, reflecting its adaptive approach to changing market dynamics.

By managing billions in private capital, Brookfield offers institutional investors consistent access to premium global real estate. Their in-depth operational management and long-term perspective exemplify the stability and sophistication that private funds can achieve.

Starwood Capital Group

Starwood Capital Group operates numerous private real estate funds with diverse investment goals, including residential, commercial, and hospitality assets. The firm is known for identifying undervalued properties and transforming them into high-performing investments through redevelopment and efficient management.

This example demonstrates how private funds can adapt to different market cycles, focusing on acquiring distressed assets during downturns and capitalizing on recovery trends.

Benefits of Investing in Private Real Estate Funds

Portfolio Diversification

Private real estate funds provide investors access to a variety of asset classes and geographical regions. By diversifying across multiple properties, investors reduce exposure to single-market volatility. This strategy strengthens portfolio stability while delivering consistent income from rental yields.

Passive Income Generation

Investors benefit from recurring income distributions without the burden of managing properties. Professional fund managers oversee maintenance, tenant relations, and leasing, allowing investors to focus on broader financial goals.

Inflation Hedge

Real estate typically appreciates with inflation, as property values and rents rise over time. Private funds offer a natural hedge against inflation, preserving purchasing power while generating real returns.

Professional Expertise

Fund managers bring extensive market knowledge, negotiation skills, and access to off-market deals. Their ability to identify opportunities, optimize assets, and time exits enhances the fund’s profitability.

Tax Efficiency

Private funds often employ strategic tax planning through depreciation, interest deductions, and fund structuring. These advantages can improve net returns, particularly for high-net-worth individuals.

How Technology Enhances Private Real Estate Funds

Technology has revolutionized how private real estate funds operate. From deal sourcing to investor communication, digital tools streamline operations and increase transparency.

Data Analytics and Market Intelligence

Advanced analytics tools help fund managers identify promising markets and predict property value trends. Algorithms assess factors like population growth, rental demand, and local infrastructure development to guide acquisition strategies. This data-driven approach minimizes risk and improves decision-making.

Digital Investor Portals

Investors now access real-time performance data through secure online platforms. These portals display asset valuations, rental income reports, and fund updates, enhancing trust and communication. The use of blockchain-based systems also ensures transparency in transaction records.

Automation in Property Management

Smart property management platforms automate maintenance requests, tenant communications, and expense tracking. This reduces administrative burden and improves operational efficiency, allowing fund managers to focus on maximizing asset performance.

Artificial Intelligence (AI) in Risk Assessment

AI-driven models evaluate financial risk by analyzing property history, tenant behavior, and regional trends. Such predictive insights allow fund managers to anticipate challenges and optimize portfolio balance proactively.

Practical Use Cases of Private Real Estate Funds

Institutional Investors Seeking Long-Term Yield

Institutional investors such as pension funds and insurance companies use private real estate funds to achieve steady returns and diversification. The funds’ predictable income and tangible asset backing make them an ideal complement to traditional securities.

Wealth Management for High-Net-Worth Individuals

Affluent investors use private real estate funds to gain exposure to premium assets without managing them directly. This approach provides access to institutional-grade opportunities that are typically unavailable through public markets.

Economic Recovery and Redevelopment Projects

During economic downturns, private funds often acquire undervalued or distressed assets. By repositioning or redeveloping these properties, they help stimulate local economies while generating attractive returns upon recovery.

Global Market Diversification

Private real estate funds allow investors to access properties across continents, spreading geopolitical and currency risks. For example, a fund may hold assets in North America, Europe, and Asia, balancing exposure to different economic environments.

Benefits of Technology Integration for Investors

- Transparency: Real-time data access fosters investor confidence and ensures accountability.

- Operational Efficiency: Automation reduces errors and enhances property performance tracking.

- Accessibility: Digital dashboards simplify portfolio monitoring and communication.

- Predictive Insights: AI tools anticipate trends, enabling proactive investment decisions.

- Cost Reduction: Streamlined systems minimize administrative overhead, boosting net returns.

Technology empowers investors to stay informed and engaged, bridging the gap between traditional property ownership and modern fund management.

Risks and Considerations

Despite their advantages, private real estate funds carry certain risks:

- Liquidity Constraints: Funds are typically locked for years, limiting early withdrawal.

- Market Volatility: Economic downturns can affect rental yields and property values.

- High Entry Requirements: Only accredited or institutional investors can typically participate.

- Management Performance: The fund’s success heavily depends on the expertise of its managers.

- Regulatory Risks: Real estate laws and tax structures vary across jurisdictions and may impact returns.

Careful due diligence, fund analysis, and diversification across multiple vehicles can mitigate these risks.

Why Private Real Estate Funds Appeal to Modern Investors

Private real estate funds have become an essential part of diversified portfolios, offering both stability and growth potential. As public markets fluctuate, tangible assets provide reassurance through physical value and long-term demand. The combination of professional management, advanced technology, and global reach makes these funds particularly attractive to investors seeking balanced exposure.

For individuals and institutions alike, private real estate funds represent an evolution in property investment — one that merges sophistication, security, and scalability. They serve not only as a source of steady income but also as a tool for wealth preservation across generations.

Frequently Asked Questions (FAQ)

1. What distinguishes a private real estate fund from a REIT?

Private funds are not publicly traded and have limited investor access. They often require higher minimum investments but offer greater flexibility and potential returns compared to REITs, which trade on public exchanges and cater to retail investors.

2. How long is the typical investment period?

Most private real estate funds operate for seven to ten years. During this period, capital is committed, properties are acquired and managed, and profits are distributed at the end of the term.

3. Are private real estate funds suitable for all investors?

No. These funds are designed for accredited investors or institutions capable of committing substantial capital and tolerating long investment horizons. However, they can deliver strong diversification and inflation protection for suitable participants.