Equity Estates Fund Explained: How Luxury Residence Investment Funds Work

The Equity Estates Fund is a distinctive investment concept designed to merge high-end real estate ownership with luxury travel experiences. Instead of purchasing a single vacation home or joining a traditional timeshare, investors become shareholders in a diversified fund that owns multiple multi-million-dollar residences around the world.

The fund model offers two intertwined benefits: ownership in appreciating real estate assets and the ability to personally use these residences for vacations. Investors contribute capital to the fund, which then acquires a collection of premium homes in desirable destinations such as beach resorts, mountain retreats, and urban centers. Each investor gains an equity interest proportional to their investment and a set number of annual usage nights across the portfolio.

What differentiates Equity Estates from typical vacation programs is its exit plan. Each fund operates for a defined term, often around ten years. At the end of that period, the fund liquidates its properties, returning 100 % of the initial investment to investors and then distributing a large portion of any appreciation profits. This structure ensures transparency, accountability, and alignment between the sponsor and investors.

How the Fund Structure Works

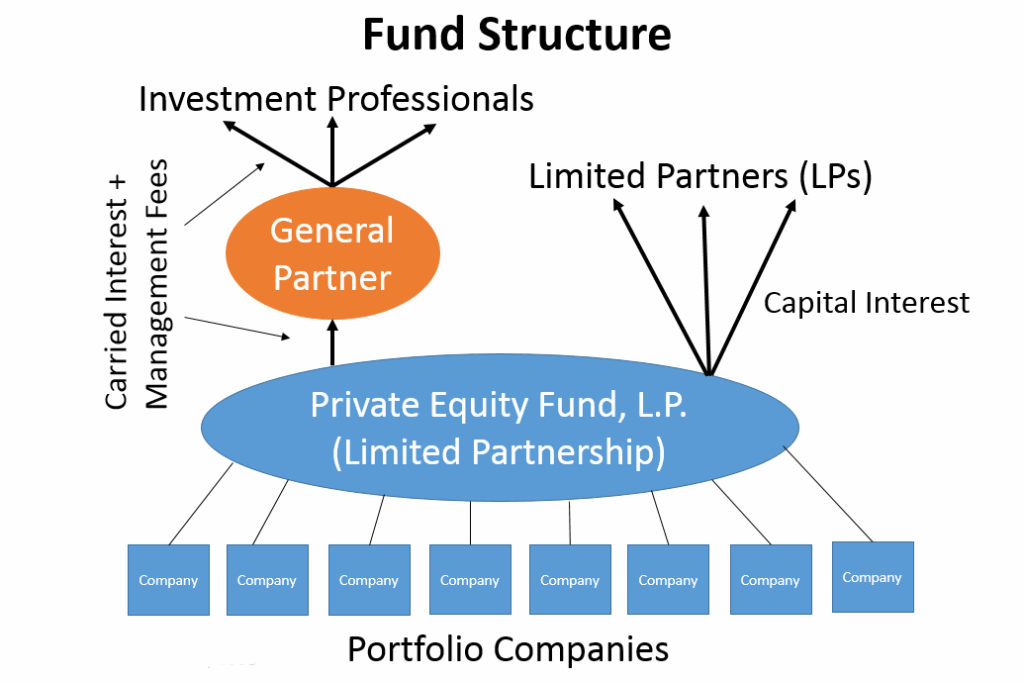

The Equity Estates Fund operates like a private real-estate investment partnership. Accredited investors contribute a fixed amount of capital, and the fund uses that capital to purchase a portfolio of luxury residences. These homes are not open to the public; they are reserved exclusively for investor use. The fund’s professional management team oversees property acquisition, maintenance, staffing, concierge services, and eventual sale.

Every investor receives a certain number of nights each year to enjoy any property within the portfolio. The number of nights is tied to their capital contribution level, and the booking system ensures fair access across the investor base. When the fund concludes, all homes are sold, and investors receive back their principal investment first. After that, the net appreciation from property sales is divided between investors and the fund sponsor, usually with the majority going to investors.

This model combines elements of private equity and lifestyle ownership. Investors hold equity rather than usage rights alone, meaning their capital participates in potential appreciation. In essence, Equity Estates transforms the concept of a vacation club into a real-estate asset class—combining leisure with long-term wealth preservation.

Real-World Examples and Use Cases

Diversified Global Portfolio

A typical Equity Estates fund might acquire ten to twelve luxury homes worth several million dollars each. Properties often span destinations such as Hawaii, the Caribbean, Europe, and the United States. By owning a share of this diversified portfolio, investors reduce exposure to a single market’s volatility. For example, if property values dip in one region, appreciation in another can offset that decline. This diversification principle mirrors what institutional real estate funds practice, but on a lifestyle scale.

Vacation Access for Investors

Investors receive between fifteen and forty-five nights per year for personal use, depending on their investment level. Each stay includes full concierge service, housekeeping, and on-site support—making the experience comparable to a five-star resort stay. Because the fund professionally manages the properties, investors can arrive and enjoy their vacation without worrying about upkeep, bookings, or local arrangements.

This model appeals to those who frequently travel but prefer the comfort of private residences rather than hotels. It also helps avoid the financial inefficiency of owning multiple second homes that sit vacant most of the year.

Long-Term Appreciation and Exit

After roughly a decade, the fund sells its portfolio and distributes proceeds to investors. They receive back their entire original investment, followed by a majority portion of any capital gains. For instance, if the homes collectively appreciate, that appreciation is shared primarily among the investors. The planned liquidation provides a clear endpoint and potential return, making the investment less open-ended than other vacation ownership models.

Key Benefits of the Equity Estates Model

1. Combination of Lifestyle and Investment

The greatest advantage of this model lies in blending tangible enjoyment with financial prudence. Investors gain access to luxury vacation properties while also owning a share of appreciating real estate. This approach transforms travel spending into asset-backed participation. The fund essentially turns leisure into a form of portfolio diversification.

2. Professional Management

Owning multiple vacation homes can be a logistical burden managing maintenance, taxes, and staffing for each property. The Equity Estates Fund eliminates these challenges through professional oversight. A central management team handles everything from acquisition to property upkeep. Investors can travel freely, knowing that the residences are well-maintained and ready upon arrival.

3. Defined Exit Strategy

Unlike most fractional or timeshare programs that lack liquidity, each Equity Estates Fund comes with a predetermined exit timeline. After approximately ten years, the fund liquidates its portfolio, ensuring investors can recover their capital and share in any appreciation. This feature provides more certainty than open-ended vacation clubs, which may offer little or no resale potential.

4. Diversification and Risk Reduction

By investing in multiple luxury homes in different global markets, investors reduce exposure to local real-estate cycles. This diversification spreads risk across geographies, property types, and currencies. Even during fluctuations in one region, other destinations may perform strongly—helping preserve overall fund value.

5. Transparency and Governance

The fund’s structure typically includes independent audits, annual reporting, and performance updates. These governance mechanisms enhance investor confidence and differentiate it from opaque ownership models. Clear legal documentation defines usage, profit distribution, and operational responsibilities.

The Role of Technology in the Equity Estates Fund

Technology plays a major role in how the Equity Estates Fund operates. From property acquisition analysis to member reservations, digital tools streamline both the investor and guest experience.

Booking and Reservation Systems

A centralized online platform allows investors to browse homes, check availability, and book travel dates directly. Algorithms manage scheduling fairly among investors, balancing peak demand seasons. This system ensures that everyone enjoys equitable access without administrative hassle. It also tracks travel patterns to help the management team optimize property usage and maintenance schedules.

Digital Asset Management

Each property in the fund’s portfolio is managed through digital asset-tracking systems. These tools monitor maintenance, budgets, renovation schedules, and occupancy data. They help maintain property quality and value while keeping investors informed. Reports are accessible through investor dashboards, giving transparency over how assets are managed.

Data-Driven Market Analysis

Before acquiring a residence, the fund uses analytics to evaluate potential returns, rental comparables, and local real-estate trends. Data tools enable the team to identify undervalued luxury properties with long-term appreciation potential. The same analytics guide decisions about when and where to sell at the end of the fund’s term.

Investor Communication and Transparency

Through a secure portal, investors can review financial updates, performance summaries, and portfolio photos. This digital access simplifies communication and builds trust. Technology thus enhances both the operational efficiency and investor satisfaction within the fund.

Benefits of Technology Integration

The integration of technology within the Equity Estates Fund brings several practical advantages:

- Efficiency: Automated systems streamline reservation management, maintenance tracking, and financial reporting.

- Accessibility: Investors can access all information—availability, performance, and documents—anytime, anywhere.

- Consistency: Digital processes ensure that service quality and property upkeep remain uniform across locations.

- Cost Control: Analytics help reduce waste, optimize staffing, and maintain operational margins.

- Transparency: Real-time visibility builds investor confidence and reduces administrative delays.

These advantages illustrate how technology transforms luxury real-estate ownership into a modern, data-driven experience.

How the Fund Solves Real-World Problems

Investors Seeking Passive Luxury Ownership

Many affluent investors want access to multiple vacation homes without the burden of direct ownership. The Equity Estates Fund solves this by pooling capital to buy homes collectively, removing maintenance headaches while preserving ownership benefits. It caters to individuals who prefer flexibility—enjoying different destinations each year—without the inefficiency of unused second homes.

Diversifying a Wealth Portfolio

Family offices and high-net-worth individuals often allocate part of their capital to alternative investments. The Equity Estates Fund offers exposure to tangible assets—real estate—while also delivering lifestyle returns. It provides a counterbalance to traditional investments like equities or bonds, offering both diversification and experiential value.

Simplifying Estate and Legacy Planning

For some investors, the fund represents a way to pass on lifestyle and wealth simultaneously. Rather than leaving one or two physical homes to heirs, investors hold shares in a professionally managed portfolio with defined liquidity. This simplifies estate planning, reduces management complexity for heirs, and ensures fair asset distribution.

Frequent Travelers Seeking Quality Assurance

Luxury travelers often struggle to find consistent quality and service when booking high-end accommodations around the world. The Equity Estates Fund solves this issue by owning and managing each property directly, maintaining uniform standards. Investors enjoy reliability in every destination, from decor and amenities to service levels.

Risks and Considerations

While the model offers significant appeal, potential investors should evaluate its risks carefully:

- Limited Liquidity: Investments are typically locked for the duration of the fund term. Early withdrawal options may be restricted.

- Market Dependence: Real-estate values can fluctuate with economic cycles, interest rates, and regional demand.

- High Entry Threshold: Only accredited investors with significant capital qualify for participation.

- Usage Competition: During peak travel seasons, demand for certain homes may exceed availability, though the reservation system manages fairness.

- Management Costs: Annual fees cover maintenance, staffing, and operations, which should be factored into total returns.

- Appreciation Uncertainty: Future property values depend on broader market trends, so returns are not guaranteed.

Investors should assess these elements relative to their financial goals and risk tolerance. Consulting financial and legal advisors is essential before participation in any private real-estate fund.

Why Investors Choose the Equity Estates Approach

The model’s success lies in addressing the modern investor’s dual desire for both experience and value preservation. Traditional vacation ownership has lost appeal due to limited flexibility and low resale potential. Meanwhile, direct luxury home ownership ties up large capital and demands significant personal management.

The Equity Estates Fund bridges this ga,p transforming luxury travel into an equity-backed asset. Investors gain diversified property exposure, predictable liquidity timelines, and transparent governance. Additionally, the emotional return of vacation experiences adds a unique layer of satisfaction beyond financial metrics.

For those looking to blend enjoyment, wealth management, and real-estate diversification, this approach represents a balanced solution. It’s not merely an investment in properties but in a lifestyle of access, convenience, and long-term value.

Summary

The Equity Estates Fund stands at the intersection of finance and lifestyle. It transforms luxury vacation home ownership into a structured investment, allowing individuals to enjoy premier destinations while participating in potential real-estate gains. Through diversification, technology integration, and professional management, the model reduces the burdens of ownership and enhances transparency.

Investors benefit from predictable exits, exclusive property access, and a hands-off management experience. While the fund requires accredited investor status and a long-term perspective, it offers a rare combination of emotional and financial rewards. In an era where experiential investments are increasingly valued, the Equity Estates Fund exemplifies how innovation continues to reshape the luxury real-estate landscape.

Frequently Asked Questions (FAQ)

1. What type of investor is best suited for the Equity Estates Fund?

This fund is designed for accredited investors seeking a blend of personal lifestyle benefits and real-estate exposure. It suits individuals who travel frequently, value consistent luxury experiences, and prefer professional property management over direct ownership.

2. How long does the investment typically last?

Each fund generally operates for about ten years. At the end of that period, the portfolio is sold, and investors receive their initial capital back plus a share of any net appreciation. This defined term distinguishes the model from perpetual vacation programs.

3. Are there ongoing costs beyond the initial investment?

Yes. Investors pay annual dues to cover property maintenance, management, and concierge services. These fees ensure that all residences remain in top condition and ready for use at any time.