Commercial SMSF Loans Explained: Structure, Benefits, and Real-World Applications for Investors

A Commercial SMSF Loan is a specialized financial product that allows a self-managed superannuation fund (SMSF) to borrow money for purchasing commercial real estate. These properties may include offices, warehouses, retail stores, or industrial buildings. The income and capital growth generated from these properties are held within the SMSF structure, contributing to members’ retirement savings.

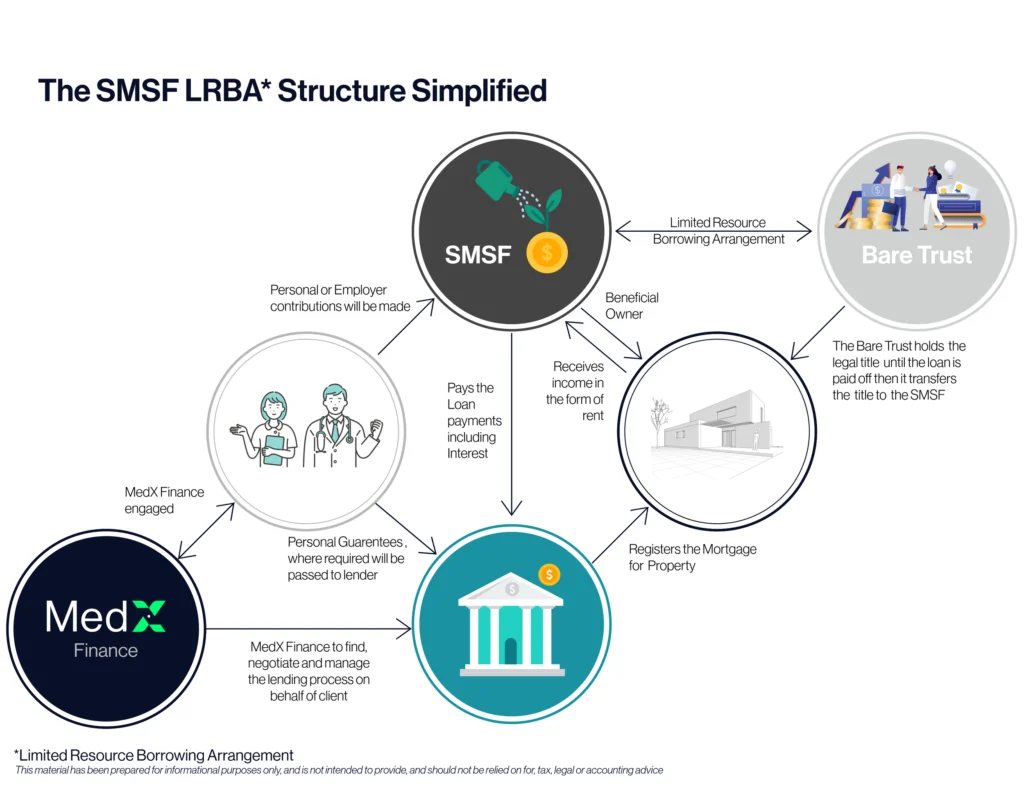

Unlike traditional property loans, commercial SMSF loans must adhere to Australian Taxation Office (ATO) regulations. The fund can only borrow under a Limited Recourse Borrowing Arrangement (LRBA), ensuring that if the SMSF defaults, the lender’s recourse is limited to the property securing the loan. This structure protects other fund assets from being exposed to potential loss.

Commercial SMSF loans are particularly attractive for small business owners who wish to purchase business premises through their SMSF and lease them back to their own company under strict market-value rental terms. This strategy provides long-term stability and allows rent payments to flow back into the member’s retirement fund rather than to an external landlord.

How a Commercial SMSF Loan Works

When an SMSF decides to acquire a commercial property using borrowed funds, it must follow specific steps to comply with superannuation and taxation laws.

First, the SMSF establishes a bare trust, also known as a holding trust, which legally holds the property title on behalf of the fund until the loan is fully repaid. The SMSF then makes the deposit and secures financing through a bank or non-bank lender offering SMSF-compliant loans. The lender’s security is limited to the property, meaning no other SMSF assets can be claimed if default occurs.

The income generated from leasing the property, whether to the member’s own business or a third-party tenant, is directed into the SMSF. This income is then used to service the loan repayments. Over time, as the loan principal reduces, the SMSF builds equity in the property. Once the loan is repaid, full legal ownership transfers from the bare trust to the SMSF.

This structure allows members to grow their retirement wealth using property investment while complying with the rules of the Superannuation Industry (Supervision) Act 1993 (SIS Act).

Eligibility and Key Requirements

To qualify for a commercial SMSF loan, several criteria must be met:

- The SMSF must be properly structured with a corporate trustee or individual trustees.

- The property must meet the sole purpose test, meaning it is acquired solely to provide retirement benefits to fund members.

- The loan must be established under a Limited Recourse Borrowing Arrangement (LRBA).

- The SMSF cannot make improvements to the property using borrowed funds (though maintenance and repairs are allowed).

- Rent paid by related parties, such as a business owned by the SMSF member, must reflect market value and be paid on time.

The loan-to-value ratio (LVR) for commercial SMSF loans typically ranges between 60% and 70%, depending on the lender’s policies.

Real-World Examples of Commercial SMSF Loans

A Business Owner Buying Office Space

John and Lisa run a successful accounting firm and decide to purchase office premises valued at $800,000 through their SMSF. They contribute a $300,000 deposit from their fund and borrow the remaining $500,000 under a commercial SMSF loan.

Their SMSF leases the office to their accounting business at a market rate of $50,000 per year. Rent payments flow directly into the SMSF, helping to cover loan repayments and build retirement savings. Over time, the property appreciates, increasing the SMSF’s asset base and retirement benefit potential.

This example highlights how small business owners can use SMSFs strategically to own commercial premises, enjoy potential tax advantages, and maintain compliance with ATO rules.

Investing in a Retail Complex

A self-managed super fund with four members invests in a retail complex valued at $2 million. Using a commercial SMSF loan, the fund borrows $1.2 million while contributing the remaining $800,000 in cash. The property is leased to independent retailers, generating consistent rental income.

The rental yields, combined with capital appreciation, help the fund achieve stable long-term returns. This setup also provides diversification away from traditional equities and fixed-income investments, strengthening the fund’s overall portfolio.

Purchasing a Warehouse Facility

An SMSF identifies a logistics warehouse near a major port as a promising investment opportunity. After securing a commercial SMSF loan, the fund purchases the property for $1.5 million. The warehouse is leased to a logistics company under a 10-year lease agreement.

Rental income from the tenant not only services the loan but also generates surplus cash flow, which is reinvested into other assets within the SMSF. As the property appreciates, the fund gains both capital growth and consistent income, strengthening members’ retirement positions.

Benefits of Commercial SMSF Loans

Long-Term Wealth Accumulation

A commercial SMSF loan allows investors to acquire high-value assets that would otherwise be unaffordable. The combination of property appreciation and rental income contributes significantly to long-term wealth growth within the fund.

Because SMSFs enjoy concessional tax treatment, rental income and capital gains are generally taxed at lower rates compared to personal ownership, enhancing overall returns.

Ownership and Control

Unlike traditional managed funds or superannuation platforms, an SMSF provides direct control over investment decisions. Members can select the type of property, negotiate lease terms, and make informed financial choices aligned with their retirement strategy.

Tax Efficiency

Commercial SMSF properties benefit from concessional tax rates of 15% on rental income anda potential 10% on capital gains if held for more than 12 months. Additionally, if the property remains within the fund during the pension phase, income and capital gains may become tax-free.

Stability and Prand ble Income

Commercial properties often provide long-term leases, offering predictable and stable income streams to the SMSF. This is particularly beneficial for retirement planning, where consistent cash flow supports sustainability and fund growth.

Protection of Fund Assets

The limited recourse structure of commercial SMSF loans ensures that only the property purchased is exposed to risk. Other SMSF assets remain protected even if the property underperforms or defaults occur.

How Technology Enhances Commercial SMSF Loan Management

Modern technology has simplified the management of SMSFs and commercial property loans, allowing trustees and advisers to make informed decisions efficiently.

Digital Platforms for Loan Monitoring

Advanced online portals provide real-time visibility into loan repayments, interest charges, and property performance. These dashboards help trustees monitor compliance and ensure timely payments without manual record-keeping.

Automated Accounting and Reporting Tools

Cloud-based software integrated with SMSF administration platforms automatically tracks rental income, expenses, and loan amortization. This reduces human error, streamlines auditing, and ensures accurate tax reporting.

Data Analytics for Property Valuation

Machine learning and predictive analytics tools evaluate property values based on market trends, rental yields, and economic data. This technology helps trustees identify growth opportunities and mitigate risk through data-driven insights.

Secure Digital Document Management

All loan-related contracts, compliance reports, and valuation records can be securely stored online using encrypted cloud storage. This enhances transparency, ensures regulatory compliance, and simplifies annual audits.

Use Cases of Commercial SMSF Loans in Real Life

Expanding a Family Business

A family-owned manufacturing company decides to purchase a new warehouse through its SMSF. The SMSF secures a commercial loan to acquire the facility and leases it back to the business at market rates. Rent payments effectively transfer business income into the family’s retirement savings, building wealth while maintaining full compliance.

Diversifying Retirement Investments

An investor nearing retirement uses a commercial SMSF loan to purchase a small office building. The rental income supplements their SMSF’s cash and equity holdings, providing diversification and reducing reliance on stock market volatility.

Passive Income for Early Retirement

A couple in their 50s invests in a retail property through their SMSF with a long-term lease agreement. The steady rental income covers the loan and creates a surplus, allowing the couple to plan for an early retirement with a stable, predictable cash flow.

Benefits of Technology Integration for SMSF Trustees

- Improved Transparency: Real-time access to financial data ensures better oversight.

- Reduced Compliance Burden: Automation simplifies ATO reporting and document submissions.

- Enhanced Decision-Making: Predictive analytics help trustees forecast rental yields and market value shifts.

- Efficiency in Communication: Secure digital messaging between trustees, lenders, and auditors minimizes delays.

- Cost Savings: Digital processes reduce administrative and accounting costs associated with property and loan management.

Risks and Considerations

Despite its advantages, commercial SMSF loans come with specific challenges:

- Liquidity Constraints: Property investments tie up capital for extended periods, limiting fund liquidity.

- Borrowing Limits: Lenders impose conservative loan-to-value ratios, requiring higher deposits.

- Regulatory Compliance: Strict adherence to the SIS Act and ATO rules is mandatory.

- Market Volatility: Property values and rental yields can fluctuate with economic conditions.

- Interest Rate Sensitivity: Rising rates may impact loan affordability and returns.

Proper financial advice and due diligence are crucial to mitigate these risks and ensure compliance with superannuation laws.

Why Commercial SMSF Loans Appeal to Modern Investors

The ability to own and control tangible assets such as commercial property makes SMSFs highly attractive to investors seeking long-term stability. Commercial SMSF loans offer the flexibility to build diversified portfolios, generate consistent income, and secure valuable real estate while benefiting from tax efficiency.

In an environment of volatile stock markets and low bond yields, commercial property within an SMSF provides a balanced approach to wealth creation and retirement planning. With technology simplifying compliance, reporting, and portfolio management, trustees can now focus on strategy rather than administration.

Commercial SMSF loans represent the intersection of financial control, security, and innovation — empowering investors to grow their superannuation funds through sound property investment.

Frequently Asked Questions (FAQ)

1. Can my business lease a property owned by my SMSF?

Yes, provided the lease agreement is at arm’s length and rent payments reflect market value. This arrangement must comply with ATO regulations and the SIS Act.

2. What types of commercial properties can an SMSF buy with a loan?

An SMSF can invest in various commercial assets such as offices, warehouses, factories, retail shops, and medical suites. The key requirement is that the property serves an investment purpose aligned with retirement benefits.

3. Can borrowed funds be used for property renovations?

Borrowed funds can be used for repairs and maintenance, but not for improvements or development. Any enhancements must be financed using existing SMSF cash reserves.