SMSF Loans Explained: The Complete Guide to Self-Managed Super Fund Property Financing

In Australia, Self-Managed Super Funds (SMSFs) have become a preferred vehicle for individuals who want more control over their retirement investments. Among the most popular strategies within an SMSF is investing in property using SMSF loans, also known as limited recourse borrowing arrangements (LRBAs).

This article explores what SMSF loans are, how they function, their regulatory framework, and how they can be strategically used to grow wealth within a retirement portfolio. We’ll also highlight real-world examples, practical benefits, and the emerging role of technology in SMSF lending and property management.

What Is an SMSF Loan?

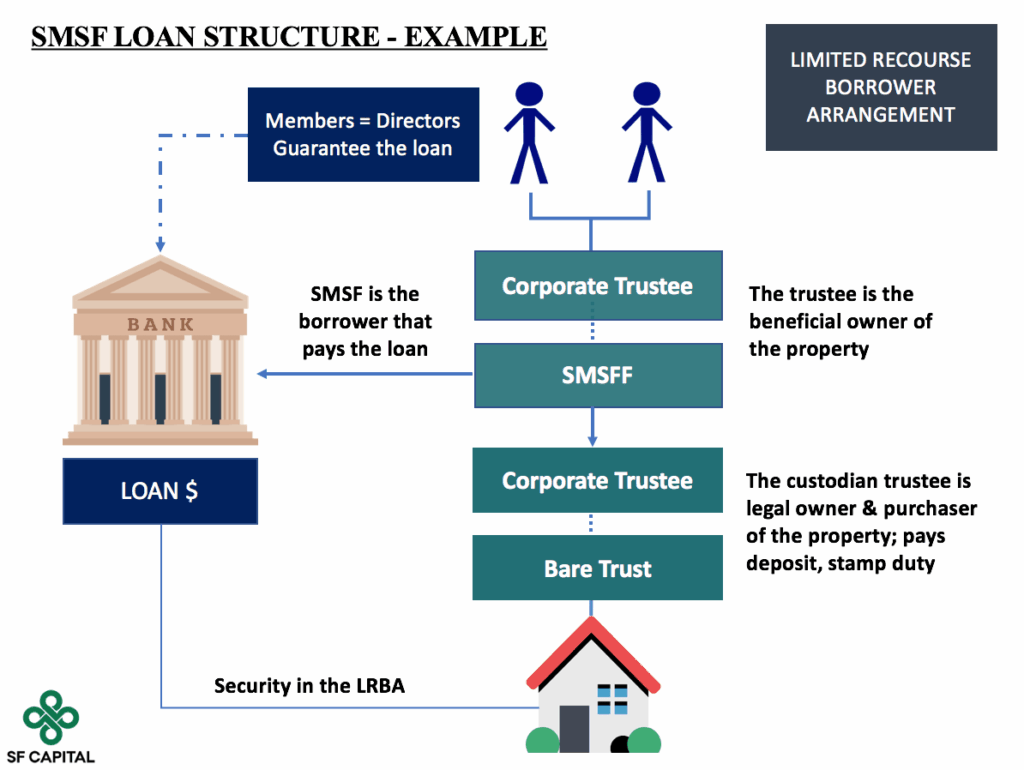

An SMSF loan is a financial arrangement that allows a Self-Managed Super Fund to borrow money to purchase an investment property. The borrowed funds, combined with the fund’s existing balance, are used to acquire an asset that is held in a custodian trust until the loan is repaid.

SMSF loans are unique because they operate under a limited recourse structure, meaning the lender’s claim is restricted to the specific property purchased with the loan. The other assets of the SMSF are protected in case of loan default, which makes this type of lending distinct from traditional property financing.

This structure is governed by Sections 67A and 67B of the Superannuation Industry (Supervision) Act 1993 (SIS Act), which outline the legal requirements for borrowing within a super fund.

How SMSF Loans Work

The structure of an SMSF loan involves several key entities:

- The SMSF Trustee – Manages the fund and decides to purchase a property using borrowed funds.

- The Custodian (Bare Trust) – Holds the legal title of the property until the loan is fully repaid.

- The Lender – Provides the limited recourse loan to the SMSF.

- The Investment Property – Generates rental income and capital growth for the fund’s members.

The SMSF receives rental income from the property, which is used to repay the loan, along with other allowable SMSF contributions. Once the loan is repaid, the legal title of the property is transferred from the custodian to the SMSF trustee.

This setup allows investors to leverage their retirement savings to build a property portfolio, while maintaining compliance with Australian Taxation Office (ATO) rules.

Eligibility Criteria and Regulations

Before an SMSF can secure a loan, it must meet strict ATO and lender requirements. These include:

- The SMSF must have a legally established trust deed that allows borrowing.

- The loan must be used to acquire a single acquirable asset, typically a property.

- The property must be held in a separate bare trust until the loan is paid off.

- The property cannot be lived in or rented by a fund member or related party.

- The SMSF must demonstrate loan serviceability, often requiring a minimum fund balance and cash reserves.

These rules exist to ensure that borrowing aligns with the sole purpose test, that is, generating retirement benefits for members, not for personal or immediate financial gain.

Advantages of SMSF Loans

Leverage to Grow Retirement Wealth

An SMSF loan allows investors to amplify their investment power by purchasing high-value assets that would otherwise be unaffordable using existing fund balances alone. Over time, this leverage can significantly increase the fund’s asset base through capital appreciation.

Tax Efficiency

Properties held under an SMSF enjoy favorable tax treatment. Rental income is typically taxed at 15%, and if the property is sold during the pension phase, capital gains tax can be reduced or eliminated.

Asset Protection

The limited recourse nature of SMSF loans ensures that if the property fails to perform, the lender can only claim against the property itself, not the SMSF’s other investments.

Passive Income for Retirement

Rental income generated from SMSF properties provides a steady cash flow that can support members’ income needs during retirement.

Real-World Examples of SMSF Loan Use

Commonwealth Bank SMSF Property Loan

Commonwealth Bank offers tailored SMSF property loans designed for both residential and commercial properties. Their loan products allow borrowers to borrow up to 70% of a property’s value and come with flexible repayment terms.

An example of a fund using this structure might be a family SMSF purchasing a commercial property that is later leased to an unrelated business. The property generates consistent rental income, which the fund uses to pay down the loan and accumulate wealth for retirement.

Liberty Financial SMSF Loan

Liberty Financial provides SMSF loans catering to both standard and complex fund structures. Their approach emphasizes serviceability analysis based on rental income and contributions rather than individual member income.

This flexibility enables smaller SMSFs with strong cash flows to acquire income-generating assets like suburban office spaces or industrial units, enhancing diversification within their retirement portfolio.

La Trobe Financial SMSF Loan

La Trobe Financial is a well-known lender offering SMSF loans for both residential and commercial investments. One of their key differentiators is a hands-on approach to compliance, ensuring that all aspects of the loan meet SIS Act standards.

For instance, an SMSF might use a La Trobe loan to purchase a medical clinic property leased to a healthcare operator. The property’s strong tenant covenant provides reliable cash flow while diversifying the fund’s exposure to the healthcare sector.

Thinktank Commercial SMSF Loan

Thinktank specializes in commercial SMSF loans, helping funds acquire offices, warehouses, and retail properties. Their products are structured with interest-only repayment options to align with long-term investment strategies.

This makes them particularly attractive for SMSFs seeking to hold commercial real estate with tenants offering long leases, such as logistics companies or medical practices.

The Role of Technology in SMSF Loans and Property Management

Technology has significantly streamlined the SMSF investment landscape, making compliance, borrowing, and property management more efficient and transparent.

Automated Compliance Tools

Platforms such as Class Super and BGL simplify recordkeeping by automating accounting, audit trails, and compliance reporting. This reduces administrative errors and helps trustees maintain full ATO compliance when managing SMSF loans.

Digital Lending Platforms

Online financial technology platforms now allow SMSFs to apply for loans, upload documentation, and track progress entirely online. These systems use AI-driven analytics to assess eligibility faster and more accurately.

Property Management Software

Cloud-based tools like PropertyMe and Console Cloud allow SMSF trustees and property managers to monitor rent collection, tenant information, and maintenance schedules from anywhere.

Data Security and Blockchain Potential

Emerging blockchain technology promises enhanced transparency and security in SMSF recordkeeping, offering immutable transaction records for audits and compliance checks.

Benefits of Using Technology in SMSF Loan Management

Improved Accuracy and Compliance

Automation reduces human error in complex financial reporting. It ensures every transaction, from loan repayments to rent income, is recorded accurately for audit purposes.

Faster Loan Processing

Digital platforms shorten loan approval times by integrating identity verification, valuation, and compliance checks into one seamless process.

Real-Time Portfolio Visibility

Technology provides trustees with instant insights into fund performance, loan balances, and asset growth, improving strategic decision-making.

Enhanced Security

Digital encryption and blockchain-based systems safeguard sensitive SMSF data from unauthorized access or tampering.

Practical Use Cases of SMSF Loans

1. Building a Property Portfolio for Retirement

Investors often use SMSF loans to purchase multiple properties across different asset types residential, retail, and industrial. This strategy diversifies income sources and builds a robust portfolio that supports members in retirement.

2. Acquiring Commercial Property for Business Use

While an SMSF cannot purchase residential property for personal use, it can buy a commercial property that is leased to a member’s business, provided rent is paid at market rates. This allows members to direct rent into their super fund, boosting retirement savings while maintaining compliance.

3. Long-Term Capital Growth Strategy

SMSF loans allow investors to gain exposure to high-growth property markets, magnifying potential returns through leverage.

4. Inflation Protection

Real estate historically performs well during inflationary periods. An SMSF property financed through a loan helps preserve purchasing power, as rental income and property values often rise in line with inflation.

Future Trends in SMSF Lending

The SMSF lending space continues to evolve with advancements in fintech, regulatory oversight, and investor education. Key trends shaping the future include:

- AI-driven loan underwriting provides more accurate borrower assessments.

- Sustainable property investments, with SMSFs increasingly financing green buildings.

- Fractional property ownershi, allows smaller funds to co-invest in large assets.

- Blockchain-enabled recordkeeping, enhancing transparency and compliance integrity.

These developments will likely make SMSF loans more accessible, efficient, and aligned with modern retirement strategies.

Frequently Asked Questions (FAQ)

1. Can an SMSF borrow to renovate a property?

No. SMSF loans cannot be used to fund property improvements that change the nature of the asset. However, funds can use available cash to perform repairs or maintenance without breaching ATO rules.

2. What types of properties can an SMSF purchase using a loan?

SMSFs can invest in both residential and commercial properties, as long as the asset complies with the sole purpose test. Residential properties cannot be occupied or leased by related parties, while commercial properties can be leased to related businesses at market rates.

3. Are SMSF loans suitable for all investors?

Not necessarily. SMSF loans involve strict regulations, significant administrative responsibility, and potential liquidity constraints. They are best suited for experienced investors or those working with professional advisors who specialize in SMSF compliance and property finance.