Real Estate Fund Administration: Comprehensive Guide to Structure, Technology, and Real-World Applications

Real estate fund administration is the backbone of professional property investment management. It refers to the operational, financial, and regulatory processes that ensure real estate investment funds are efficiently managed, reported, and compliant with financial standards. Fund administrators play a crucial role in handling investor reporting, accounting, valuation, and cash flow management for private equity real estate funds, REITs, and institutional investors.

In simple terms, real estate fund administration ensures that the money flowing into and out of real estate investments is accurately tracked, reported, and managed in compliance with industry regulations. This process is especially important for investment managers overseeing multiple assets across diverse locations and investor groups.

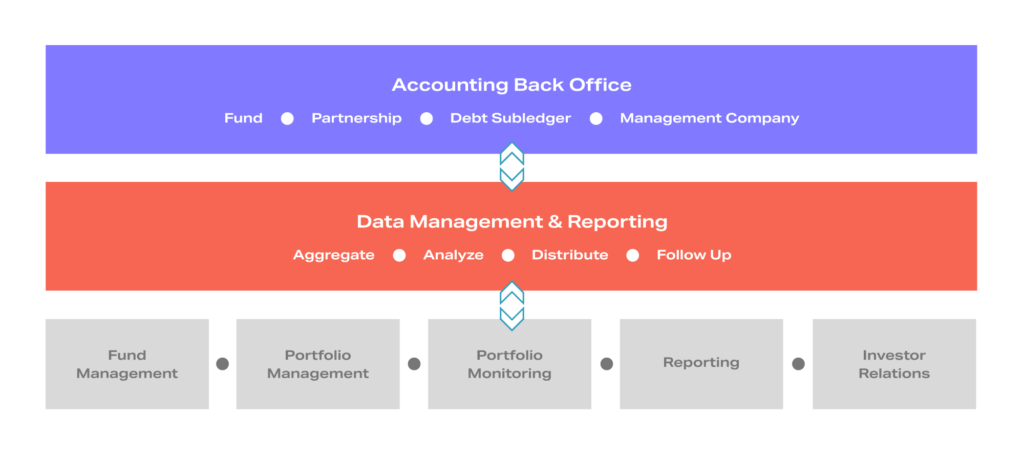

Fund administrators act as the bridge between fund managers, investors, auditors, and regulators. They handle back-office operations such as accounting, financial statements, and performance reporting while fund managers focus on investment strategy and portfolio growth. This division of responsibilities ensures transparency and trust in large-scale real estate investment structures.

The Core Components of Real Estate Fund Administration

Accounting and Financial Reporting

One of the key functions of real estate fund administration is maintaining accurate accounting records and preparing periodic financial reports. Fund administrators calculate Net Asset Value (NAV), track income and expenses, and prepare balance sheets that reflect the true financial position of the investment portfolio.

These reports are vital for investors who rely on transparent and timely updates about fund performance. Administrators often use specialized accounting platforms tailored to the unique needs of real estate funds, including property-level data integration and cash flow forecasting tools.

Investor Relations and Reporting

Real estate fund administration also encompasses investor management. Administrators maintain investor databases, process capital calls and distributions, and generate personalized statements that show investment performance. Modern fund administrators leverage secure online portals where investors can access up-to-date performance reports, tax documents, and communications in real-time.

Transparency is key. By maintaining consistent communication and detailed financial updates, fund administrators help investors make informed decisions and build confidence in the fund’s management.

Compliance and Regulatory Oversight

Compliance is another cornerstone of fund administration. With real estate funds operating under various jurisdictions, administrators must ensure adherence to local and international regulations such as anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and financial reporting standards (IFRS or GAAP).

Fund administrators keep up with changing regulatory frameworks to ensure that all filings, audits, and disclosures are completed accurately and on time. This reduces the risk of legal issues and maintains the fund’s integrity in the eyes of investors and regulators.

Technological Advancements in Real Estate Fund Administration

Modern real estate fund administration heavily relies on technology to streamline complex financial operations.

Automation and Artificial Intelligence

Automation minimizes manual errors by streamlining data entry, reconciliation, and reporting processes. AI tools can analyze market trends, forecast asset performance, and detect anomalies in financial transactions. This allows fund administrators to deliver more accurate and faster reporting while reducing operational costs.

For instance, AI-based reconciliation systems can cross-check thousands of transactions across property portfolios to identify inconsistencies or potential compliance risks, providing administrators with valuable insights before any issue escalates.

Cloud-Based Fund Management Platforms

Cloud technology enables real-time collaboration among fund managers, administrators, and investors. Platforms such as Juniper Square, Allvue Systems, and eFront provide integrated solutions for accounting, investor relations, and data analytics. Cloud-based systems enhance data security and accessibility, allowing stakeholders to view and update information from anywhere.

The use of cloud platforms ensures scalability as the fund grows; the system can seamlessly handle more data, users, and transactions without compromising performance.

Real-World Examples of Real Estate Fund Administration Solutions

1. Juniper Square

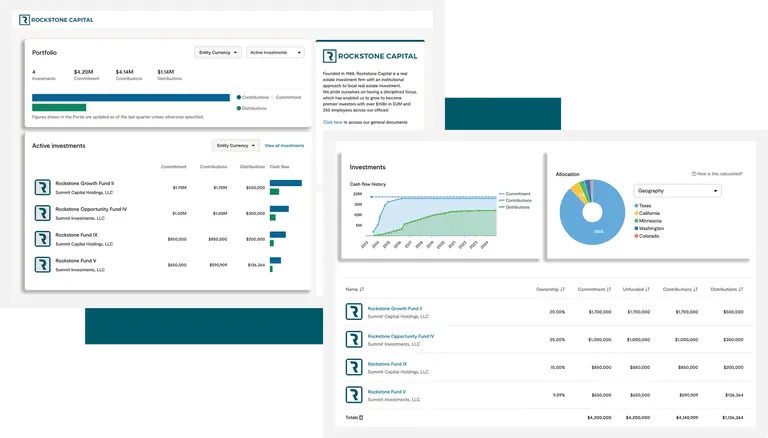

Juniper Square is a leading software platform designed to simplify investment administration. It provides comprehensive fund accounting, investor reporting, and CRM functionalities. Real estate fund managers use Juniper Square to automate workflows, manage investor communications, and generate real-time performance dashboards.

Its data transparency and integration capabilities make it ideal for private equity real estate firms that need to maintain investor confidence while scaling operations. Juniper Square’s secure cloud infrastructure also ensures compliance with data protection regulations.

2. eFront by BlackRock

eFront is another industry-standard solution that supports alternative investment management, including real estate funds. It integrates portfolio management, risk analysis, and accounting tools into one platform. eFront’s strength lies in its ability to centralize complex data sets and generate actionable insights for decision-making.

By using eFront, fund administrators can automate reporting, streamline compliance workflows, and enhance visibility into asset-level performance. The platform’s flexibility makes it suitable for both large institutional funds and smaller private investment firms.

3. Allvue Systems

Allvue Systems specializes in software solutions for private capital and credit managers. Its fund administration suite provides end-to-end capabilities for accounting, investor management, and data visualization. Allvue helps administrators achieve consistency and accuracy in financial reporting through automated data synchronization across various fund structures.

This system’s advanced analytics features enable fund managers to evaluate portfolio trends, predict cash flows, and assess investment risks in real time, all of which are crucial for informed strategic decisions.

4. MRI Software

MRI Software offers a robust suite of property management and fund administration tools tailored to institutional investors and asset managers. It combines accounting functions, investor reporting, and compliance monitoring in one environment. MRI’s real-time data analytics and customizable reporting dashboards make it a favorite among administrators managing complex real estate portfolios.

5. Yardi Investment Management

Yardi Investment Management integrates fund administration with property management operations. It allows users to track asset performance, manage investor communications, and automate financial reporting. The platform’s seamless integration with Yardi Voyager gives administrators a unified view of property and financial data, enabling more strategic fund oversight.

Benefits of Technology in Real Estate Fund Administration

The integration of advanced technology in fund administration has transformed how investment firms operate. Below are some of the key benefits:

Improved Accuracy and Efficiency

Automation reduces human error and improves the speed of data processing. Tasks such as NAV calculation, reconciliation, and reporting can now be done in minutes instead of days, freeing up time for strategic decision-making.

Enhanced Transparency and Investor Trust

Digital investor portals provide real-time access to fund performance and transaction history. This transparency builds stronger relationships between fund managers and investors, increasing confidence and retention rates.

Cost Reduction and Scalability

By automating repetitive processes and using cloud-based systems, fund administrators can significantly lower operational costs. Moreover, these technologies are scalable, supporting fund growth without requiring major infrastructure changes.

Data Security and Compliance

Advanced platforms implement multi-layer encryption and regulatory compliance modules to protect sensitive financial and investor data. This is critical in an industry where privacy and accuracy are paramount.

Practical Applications of Real Estate Fund Administration

Real estate fund administration provides solutions to several operational challenges faced by investment firms. Below are key examples of how it’s applied in real-world contexts.

Multi-Asset Portfolio Management

Large real estate funds often manage portfolios spread across multiple regions and asset classes. Fund administrators consolidate data from each property, manage financial reporting, and provide unified performance analyses, helping fund managers make informed investment decisions.

Regulatory Compliance Management

As global regulations evolve, maintaining compliance can be complex. Fund administration systems automate audit trails, ensure proper documentation, and monitor regulatory filings, reducing compliance risks and legal exposure.

Investor Transparency and Relationship Management

Administrators enhance investor satisfaction by providing digital dashboards that show real-time fund metrics, capital distributions, and performance reports. This transparency helps retain investors and attract new ones through proven accountability.

Risk and Performance Analytics

Fund administration software integrates risk modeling tools to forecast market changes and evaluate potential impacts on portfolios. These insights allow fund managers to mitigate risks and optimize investment strategies.

Frequently Asked Questions (FAQ)

1. What does a real estate fund administrator do?

A real estate fund administrator manages back-office operations such as accounting, investor reporting, compliance, and data management for investment funds. Their role ensures that the fund runs smoothly and adheres to legal and financial regulations.

2. Why is technology important in real estate fund administration?

Technology enhances efficiency, accuracy, and transparency. Automated systems streamline data processing and reporting, while digital platforms allow investors and fund managers to access real-time performance insights securely.

3. How do real estate fund administrators help investors?

Administrators provide investors with accurate financial reports, secure communication channels, and performance analytics. This transparency helps investors make informed decisions and trust the fund’s management practices.